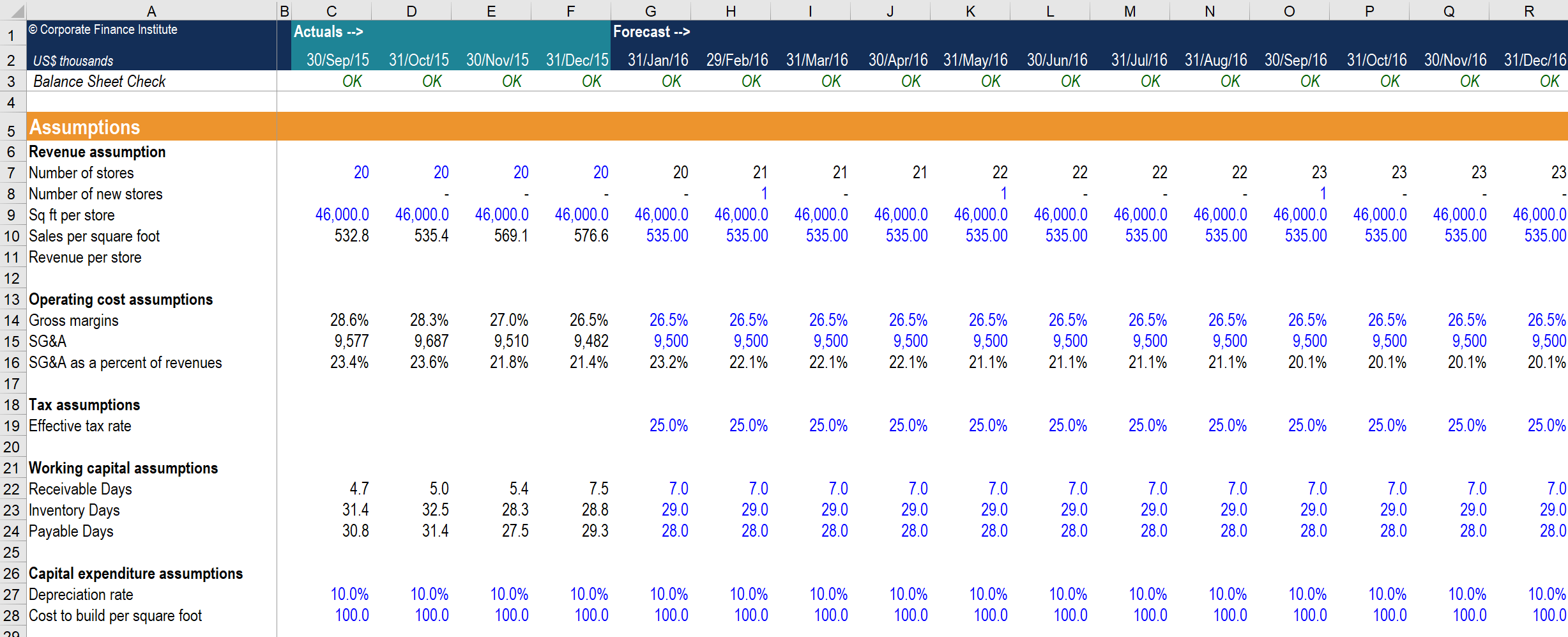

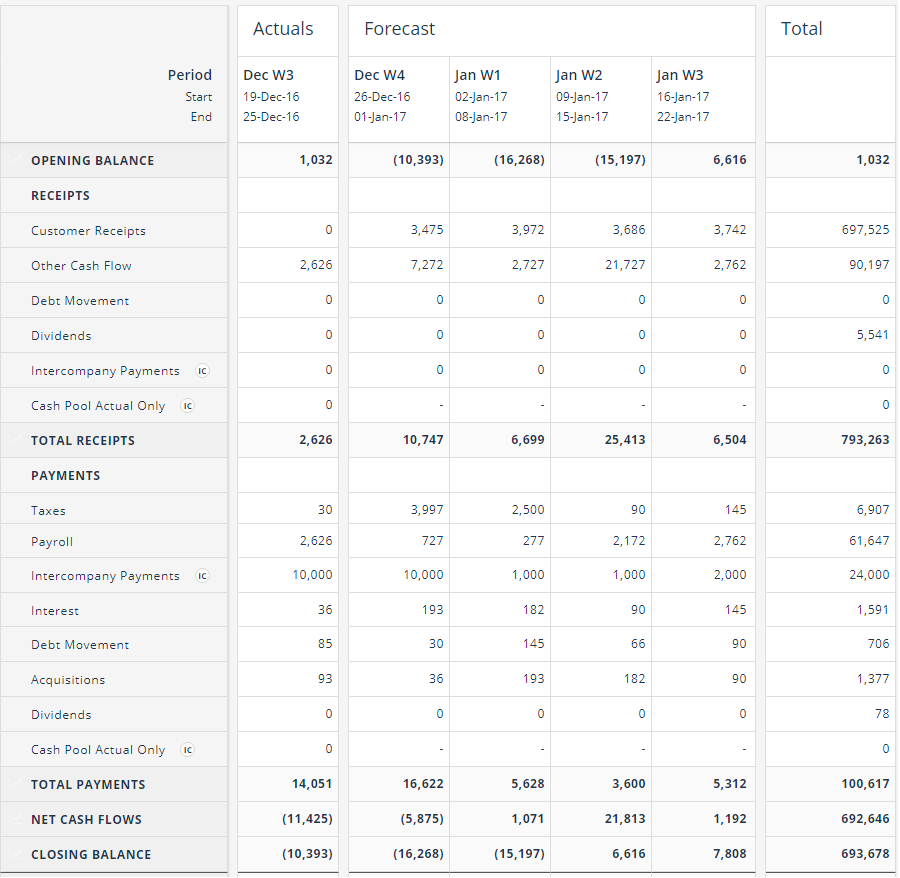

However, circumstances change so quickly for startups as they scale that the usefulness of historical data might be limited. Initially, relevant historical data is the best starting point, combined with a sensible approach to adjusting as circumstances change. The fundamental question therefore is do startups create an accurate forecast that balances ambition with pragmatism? It’s for these reasons that cashflow forecasting should sit at the heart of any business plan or growth strategy. The budget informs everything from marketing spend and new client acquisition to increasing headcount, purchasing software, or incentivising key employees. They should be prepared in line with the long-term aspirations of founders, providing critical commentary for the growth trajectory of the business and revisited and adjusted regularly. This should be reflected in regularly updated profit and loss accounts, balance sheets and cashflow forecasts so founders can make informed decisions based on the financial health of the business now and in the future.Ĭashflow Forecasting as a Business Strategyįorecasting and budgeting are about much more than crunching numbers.

Instead, startups should utilise accrual-based accounting methods, which recognizes income at the time revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid. All of which can cause unwelcome surprises for startups. However, this approach doesn’t consider more complex accounting treatments such as cash in advance and the accrual of tax liabilities or bad debt provisions. Founders might think that by noting down incoming revenue and comparing it with known expenses, they are coming up with an accurate picture of the business’s financial health. It’s for this reason that regular, accurate cashflow forecasting is essential – which we are going to take a detailed look at in this week’s newsletter.Ĭash Based Accounting Versus Cashflow ForecastingĬashflow forecasting shouldn’t be confused with cash-based accounting – a process which recognises revenues and expenses at the time cash is received or paid. We’ve all heard a variation of the phrase, cash is king, and cash often forms the steppingstones between funding rounds for startups on which their business moves forward. For many startup founders, one of the chief causes for concern is availability of cash – often referred to as runway. Whether business owners are seeking help with cash flow forecasting, assistance with resident director services or anything in between, XO Accounting is here to help.

Business owners are reminded to include annual payments, loan payments, credit card debt repayments and estimated taxes in all forecasting.Īlthough cash flow forecasting can take some getting used to at first, XO Accounting assures business owners that it could be the difference between success and failure for their business. This will reveal inaccuracies and help business owners see why the forecast may have been imprecise.

To create the most accurate cash flow forecasts, business owners must input all their cash flow data at the end of each week then compare it to what they had forecasted for that week. This will provide a comprehensive view of the future no matter what the circumstances may be. Xero account XO Accounting advises business owners to plan for best case, worst case and realistic, moderate financial scenarios when building out a cash flow scenario model.

0 kommentar(er)

0 kommentar(er)